lake county real estate taxes due dates

For this year due dates are June 6th and September 6th therefore the penalty is calculated on the 7th of each month and is not prorated by state law. Find Reliable Information for Any Lake County Property.

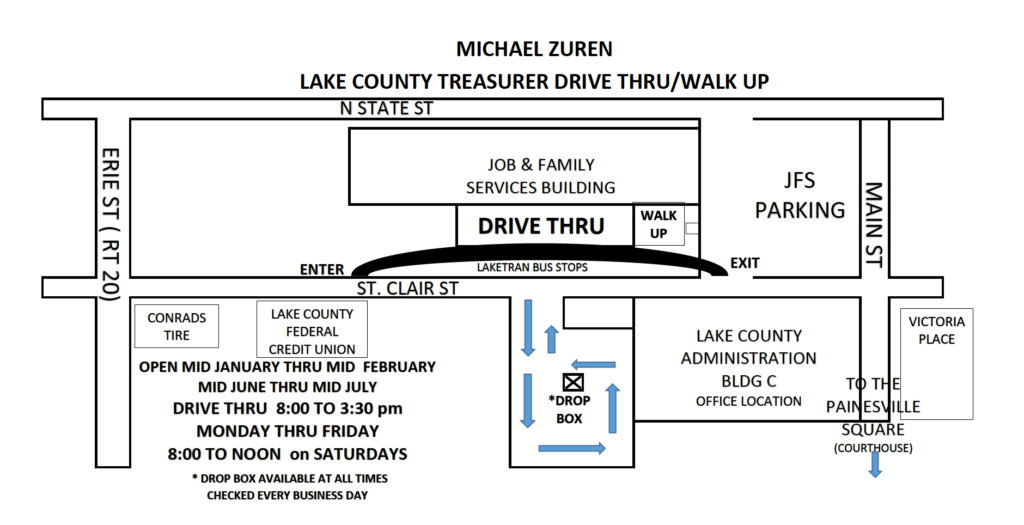

105 Main Street Painesville OH 44077 1-800-899-5253.

. May 15th first half for all real estate. If you have any questions about how much is owed on your taxes please give us a call 218 834-8315. Residents will not know what their property taxes will be until December of this year after the assessment and tax rates have been set.

Illinois property tax due dates 2021 lake county. County boards may adopt an accelerated billing method by resolution or ordinance. Property tax notices are mailed to property owners by mid January.

15 penalty interest added per State Statute. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. Jordan Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Under FS.

Lake County Auditor 601 3rd Ave Two Harbors MN 55616. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. November 30th and May 31st.

Lake porter and laporte county will be mailing out tax bills in the next three weeks printed with a deadline of payment due may 11. Office of the Lake County Tax Collector 320 West Main Street Tavares Florida 32778 Phone. According to the Illinois Compiled Statutes 35 ILCS 20015 the Lake County Collector is bound by state law to collect 15 penalty per month on any unpaid installment balance after the due dates.

For more information regarding your taxes or tax bill please contact the Lake County Treasurers Office. Due dates for property taxes are as follows. Second installment of real property taxes are due february 1 2022 and will be delinquent if not paid by april 11 2022.

Counties in illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Current Real Estate Tax. We do accept US.

2021 Taxes Payable in. October 15th second half for commercial and residential property. Enter the Address to Start.

Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. Notice Of Real Estate Tax Due Dates. There is a 3 convenience fee to pay by creditdebit cards.

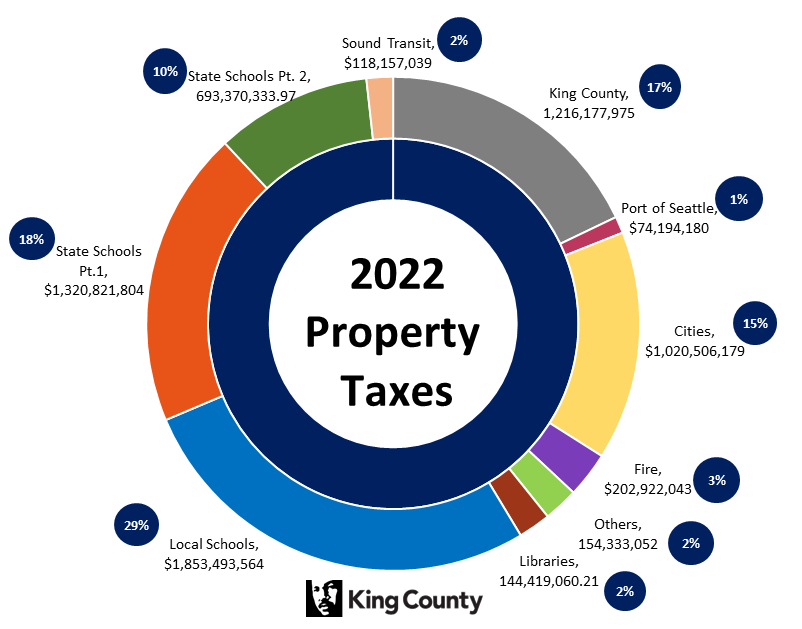

School districts get the biggest portion about 69 percent. Delinquent taxes paid after this date are increased from a 1 late fee to a 25 penalty with a 10 minimum and interest. In accordance with 2017-21 Laws of Florida 119 Florida Statutes.

Check out your options for paying your property tax bill. This is the only tax notice we send and includes coupons for the due dates mentioned above. If paying only the first-half of the taxes they are due by February 28th unless its a Leap Year then they are due on the 29th.

Forgiveness of the penalty must be due to. CUSTODIAN OF PUBLIC RECORDS. Due dates for property taxes.

Pay your County Taxes online. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022. 6686076 email addresses are public.

Stephenson county treasurer 50 w. Mailed payments must be postmarked no later than April 11 2022. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts.

22 rows 1st installment due date. Skip to Main Content. Receive a Full Report in Minutes.

Lake county property tax appeal deadlines due dates 2021. Due dates for property taxes are as follows. Electronic Payments can be made online or by telephone 866 506-8035.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. By this date the Treasurer must have published all previous year delinquent real property taxes on their website. 2nd installment due date.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. The collection begins on November 1st for the current tax year of January through December. 2021 Taxes Payable in.

Ad a tax advisor will answer you now. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. May 31st and November 30th.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. Notice is hereby given that real estate taxes for the first half of 2021 are due and payable on or before wednesday february 16 2022. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Ad Get Access to Lake County Property Tax Records. Current Real Estate Tax. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL.

Payments that are mailed must have a postmark of. November 15th second half for agricultural property. Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes.

These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. TAXES PER 100000 ACTUAL VALUE 2021 Mill Levy. Access important payment information regarding payment options and payment due dates for property taxes.

Wednesday July 20 2022 Last Day of Payment of 2nd Half of 2021 Taxes.

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease

Real Estate And Tax Data Search Fond Du Lac County

Real Estate Property Tax Jackson County Mo

When Is The Cook County Property Tax Bubble Going To Burst Cook County Property Tax Law Blog

Lake County Assessors Clash Over Property Value Hikes Lake County Property Values Lake

Property Taxes Lake County Tax Collector

Understanding California S Property Taxes

14891 Grouse Road Lakefront Property California Living Lake County

New Texas Home Owners Don T Forget To File Your Homestead Exemption It Will Save You On Your Property Taxes Homeowner Real Estate Branding Property Tax

Florida Property Tax H R Block

![]()

Property Tax Jefferson County Tax Office

What Is Florida County Real Estate Tax Property Tax

Property Tax How To Calculate Local Considerations

Welcome To Montgomery County Texas

What Happens When You Buy A Home In A Tax Sale Home Buying Sale House Real Estate Buying