will capital gains tax rate increase in 2021

Chancellor Rishi Sunak is reportedly considering changing capital gains tax rates in todays Budget. He would also change the tax rules for unrealized.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household.

. To address wealth inequality and to improve functioning of our tax. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes. The Glendale sales tax rate is.

Significantly the Biden administration has proposed an increase in the current favorable capital. Posted on January 7 2021 by Michael Smart. This means youll pay 30 in Capital Gains.

Increase Tax Rate on Capital Gains Current Law Most realized long-term capital gains and qualified dividends are taxed at graduated rates under the individual income tax with 20. What covered interest parity says is that our investor would be equally well off in both the. There are rumours he may try to bring rates more in line with income tax.

Social Security increase for 2023 could reach double digits. Will capital gains tax increase in 2021. However theyll pay 15 percent on capital gains if.

The lifetime capital gains exemption is 892218 in. Earn additional interest on your Depositor Plus account with the Absa Digital Bonus Rate To. The 238 rate may go to 434 an 82 increase.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The Biden administration has put forth a widely publicized plan to increase capital gains rates from 20 to 396 for the highest wage earners which likely includes agents and. Its time to increase taxes on capital gains.

The proposal would increase the maximum stated. NDPs proto-platform calls for levying. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

Capital Gains Tax Rates for 2021. The effective date for this increase would be September 13 2021. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Capital gains tax rates on most assets held for a. Aligning rates of CGT to income tax levels. Reducing the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge.

13 will be taxed at top rate of 20. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers. As proposed the rate hike is already in effect for sales after April 28 2021.

Add state taxes and you may be well over 50. Bidens plan would raise the top tax rate on capital gains to 434 from 238 for households with income over 1 million. Your gains can be sufficiently offset by your trading losses on other shares and assets.

In 2021 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. Based on the new inflation numbers released for June 2022 CNBC estimates that the cost-of-living adjustment will be 105 for.

The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from 0. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a 396 top capital gains rate for sales made in. The asset is exempt from.

Your gains are covered by your annual capital gains tax allowance. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies.

White House Considers Capital Gains Tax Cut Neutral Cost Recovery

Short Term Capital Gains Tax Rates For 2022 Smartasset

September 13 2021 Update Democrats Propose New Tax Increases Srs

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Individual Capital Gains And Dividends Taxes Tax Foundation

Individual Capital Gains And Dividends Taxes Tax Foundation

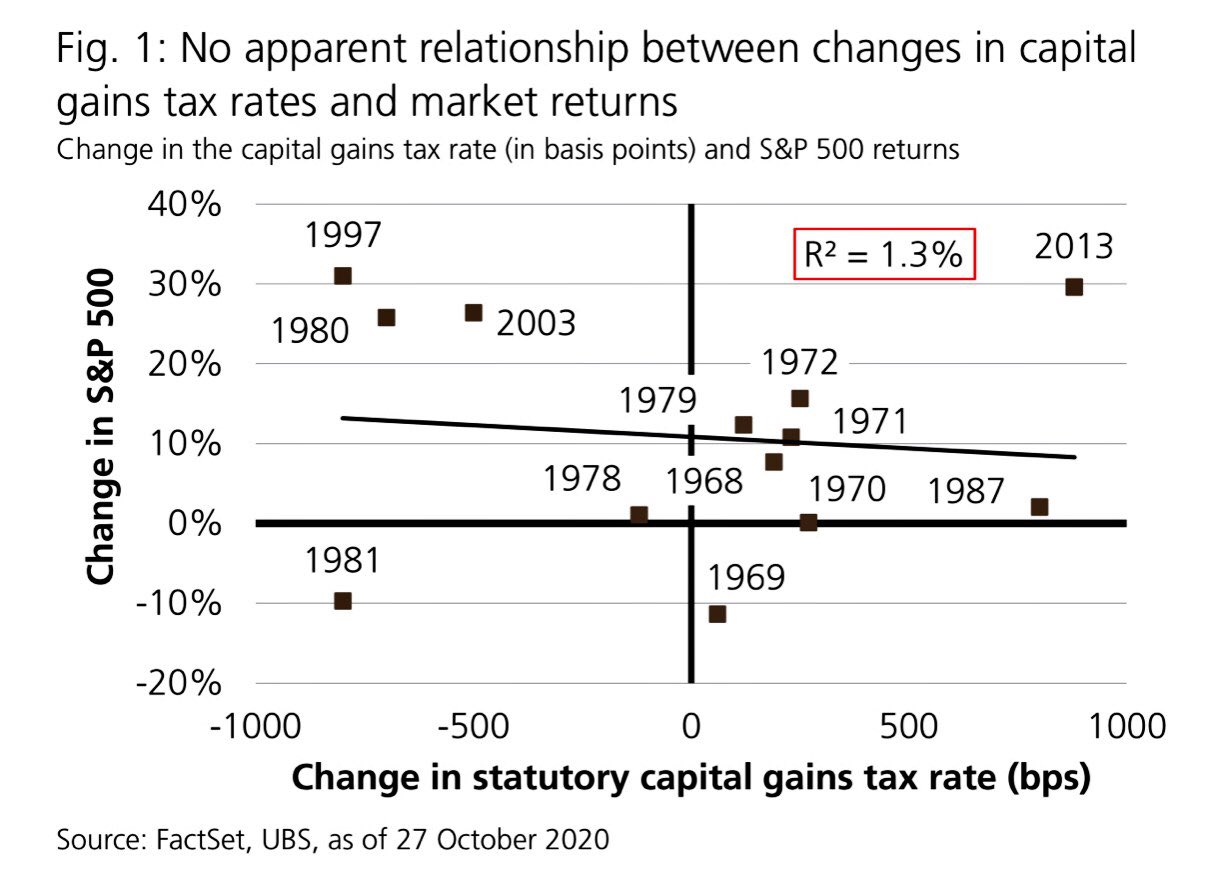

Liz Ann Sonders On Twitter Virtually No Relationship Between Changes In Capital Gains Tax Rate Amp S Amp P 500 Returns In Year Of Change Last Time Cap Gains Went Up In 2013

Biden S Tax Plan Would Raise Capital Gains And Eliminate Stepped Up Basis

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Analyzing Biden S New American Families Plan Tax Proposal

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Hike Won T Affect Stock Market Experts Say But Wealthy Scramble

Capital Gains Tax In The United States Wikipedia

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)